Credit Scoring Evaluation

- #Finance

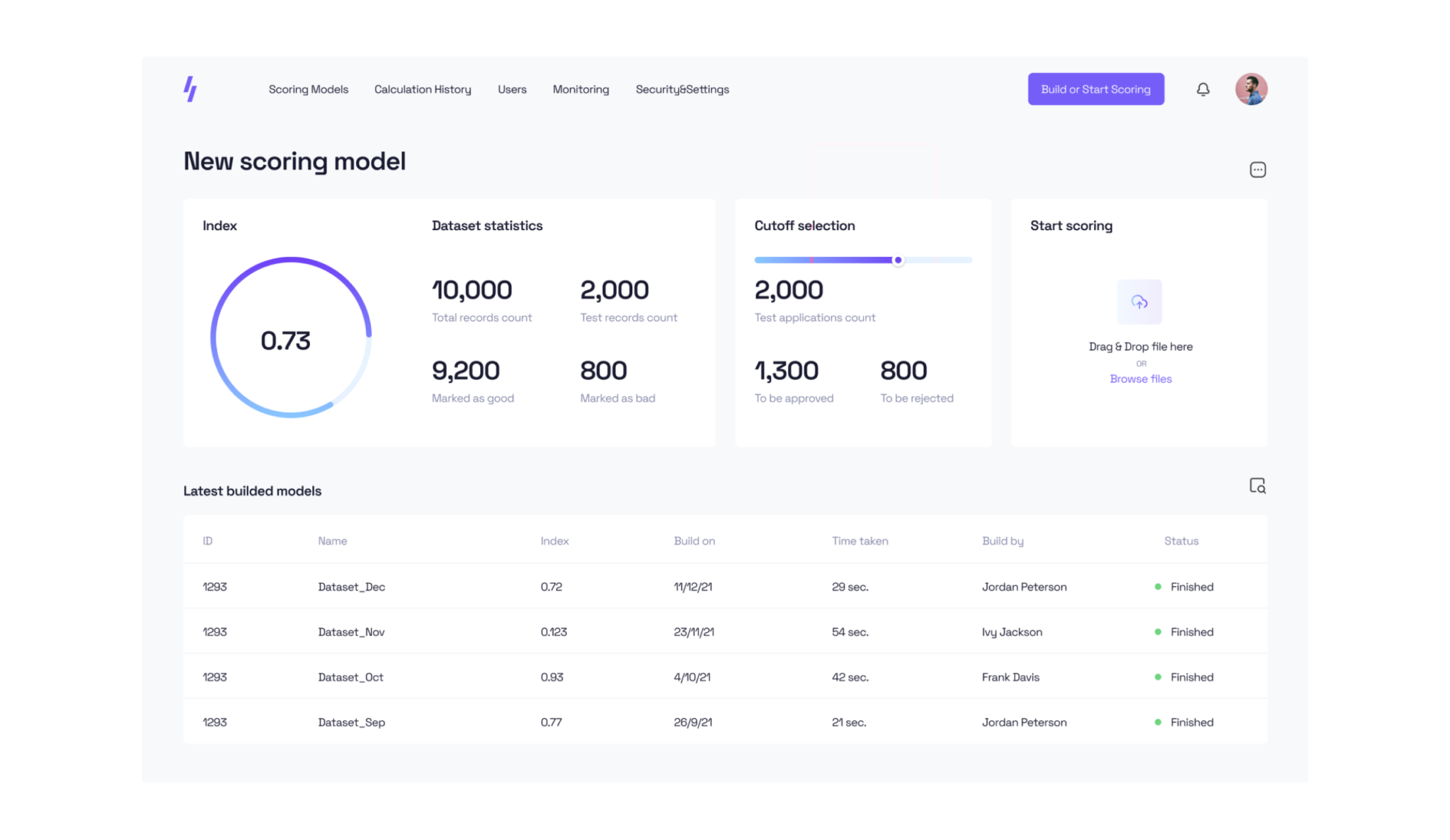

Revolutionized financial risk assessment using ML, accurate credit scores, default predictions, and NLP-based feedback categorization with AWS API deployment

- Natural Language Processing

Impact

This platform enables:

- Risk Reduction through Data Analysis: The platform leverages ML techniques to analyze extensive data sources, significantly lowering risk levels for a financial company.

- Credit Score Evaluation: Different personal information is utilized to evaluate credit scores with high accuracy, minimizing evaluation errors for clients.

- Default Prediction: ML algorithms predict customers at risk of loan default, enabling proactive changes to mitigate risks.

Services we provided

NLP solution to classify feedback on 3 categories

Develop API and AWS deployment

Tech Stack

Python

Scikit-Learn

Neural networks

Challenges and Solutions

🧐 Challenges

- Feedback Classification: Implementing an NLP solution to classify feedback into three distinct categories.

- API Development and AWS Deployment: Developing an API and deploying it on AWS for seamless and scalable access.

💡 Solutions

Achieved NLP-driven feedback categorization, enhancing analysis, and ensured efficient access by developing an API integrated with AWS for scalable deployment.